are corporate campaign contributions tax deductible

The following materials discuss the federal tax rules that apply to political campaign intervention by tax-exempt organizations. We all know that donations to charity are tax deductible.

Are My Donations Tax Deductible Actblue Support

Resources for social welfare organizations.

. It is usually deducted from the companys income before taxation. What contributions are tax deductible. Fighting Heart Disease Stroke for Nearly 100 Years - Striving to Save Improve Lives.

In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending on the type of contribution and the organization contributions to certain private foundations veterans organizations fraternal societies. Are Political Contributions Tax-Deductible. In relation to this RMC 38-2018 provides that only those.

Fighting Heart Disease Stroke for Nearly 100 Years - Striving to Save Improve Lives. The IRS has clarified tax-deductible assets. Ad Dedicated to Fighting Cardiovascular Diseases Stroke - Help Support Our Mission Today.

The official tax season has passed but the year is really just getting started. Resources for charities churches and educational organizations. Ad Dedicated to Fighting Cardiovascular Diseases Stroke - Help Support Our Mission Today.

Political contributions deductible status is a myth. For many people the. The IRS makes it.

A tax deductible expense is any expense that is considered ordinary necessary and reasonable and that helps a business to generate income. All four states have rules and limitations around the tax break. In general you can deduct up to 60 of your adjusted gross income via charitable donations 100 if the gifts are in cash but you may be limited to 20 30 or 50 depending on the type of contribution and the organization contributions to certain private foundations veterans organizations fraternal societies.

Resources for business leagues. A deduction for a contribution to a Canadian organization is not allowed if the. Resources for labor and agricultural organizations.

Internal Revenue Service IRS in Publication 535 Business Expenses An ordinary expense is one that is. What contributions are tax deductible. In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which.

IRS allows bonus tax deduction for charitable contributions this year. According to the US. The giving of campaign contributions is recognized under batas pambansa.

Are Political Contributions Tax Deductible

Resource Center Centre County United Way

Why Even Bother Having Campaign Finance Laws When Enforcement Is A Joke

Political Contributions Tax Deductions New Irs Rules

Are Political Donations Tax Deductible Credit Karma

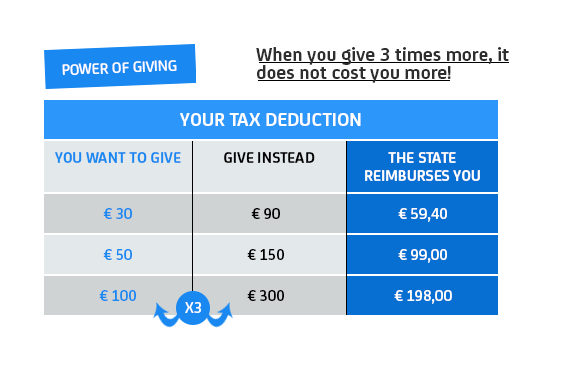

Tax Deductible Donations Institut Pasteur

Are Campaign Contributions Tax Deductible

Everything You Need To Know About Your Tax Deductible Donation Learn Globalgiving

Political Campaigns And Tax Incentives Do We Give To Get Tax Policy Center

Charitable Deduction Rules For Trusts Estates And Lifetime Transfers

Are Political Contributions Tax Deductible Tax Breaks Explained

Are Political Contributions Tax Deductible Smartasset

Tax Bill Could Make Dark Money Political Contributions Tax Deductible Cnn Politics

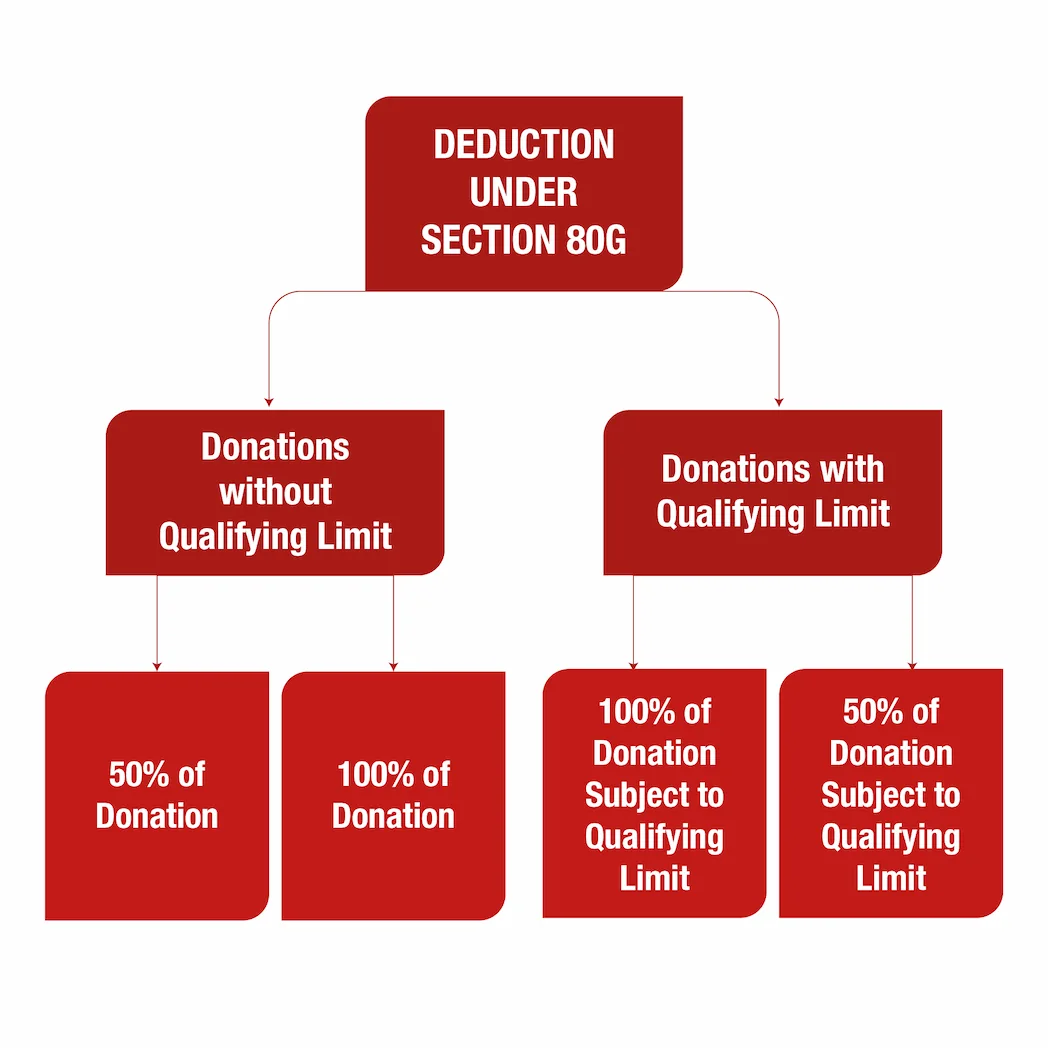

Section 80g Deduction Tax Benefits On Donation Made To Ngo

Write Off Your Marketing Expenses And Save Money On Your Taxes

Are Political Contributions Tax Deductible Turbotax Tax Tips Videos